In 2004, the President of the United States and Congress have dedicated this month for the public and private sectors to work together to raise awareness about the importance of cybersecurity. According to the Cybersecurity and Infrastructure Security Agency, this initiative has grown into a collaborative effort between government industry to enhance cybersecurity awareness, encourage actions by the public to reduce online risk, and generated discussion on cyber threats on a national and global scale.

This episode will focus on something different from our regular discussion of missing people and true crime cases. But because October is National Cybersecurity Awareness Month, and victims from North and South Carolina are not immune to cybercrimes, I thought it would be a good time to talk to a few experts about how to protect ourselves from the various scams that have been pervasive in our society, including romance scams. They are getting more and more sophisticated by the day. I should know, I was the victim of a costly one recently. But if this topic is not something that interests you, I completely understand. There are many other episodes in our catalogue that you can check out and I will not be offended.

The Zelle “Me to Me” Scam

First I want to talk about Zelle scams, as I was the victim of one recently. The payment app Zelle is popular with people because it connects your bank accounts or debit cards directly to the payment service. Unfortunately, that also means it’s almost impossible to cancel a digital payment once you’ve sent it. The Zelle competitor Venmo asks that you confirm a contact’s last four digits of their phone number before you send funds as an added layer of security. Zelle does not have this. Because my bank uses the Zelle app directly in my banking app, I thought it would be secure.

Here’s what happened to me. Someone gained access to both my debit card and credit card. They ran a small charge on my debit card that they knew would look suspicious and flag my bank. I received a text from my bank, asking if I had made the charge. This was a legitimate text. I get them frequently from my bank. Before I could finish reading the text, I received a call from my bank—or what I thought was my bank because the scammers spoofed the number of my bank’s fraud department. A man identified himself as being from my bank and said they noticed someone had scheduled a payment from Zelle and wanted to confirm it with me. He named a dollar amount. I said most definitely, no. He also said the payment was going to another state and they noticed most of my purchases came from, and then he named the town I live in. He said, “No problem, I’m going to walk you through how we can reverse the charge.”

If I had not already been nervous about suspicious activity on my debit card, I would have realized you can’t schedule a Zelle payment. It goes through immediately after you pay it. There is no scheduling option. He then had me open my banking app, go to Zelle, create a new contact named after me, and type in a confirmation number that would serve as my claim number. Well, that claim number was a phone number. The man was a smooth talker. He talked fast, and I had a hard time keeping up with what he was asking me to do. While I was on the phone with him, I supposedly reversed two different charges they could see on their end. He then asked me to close out my app, and not open it again for 24 hours. They would send me an e-mail on how to reset my username and password. This is when the hair stood up on the back of my neck and I realized I’d been scammed. I also got a text from Zelle right after I hung up with this person, telling me “Congratulations! You’ve sent X amount of dollars to Renee!”

The money was immediately siphoned from my bank account. I called the bank with the number through my banking app but it was too late. The money was gone, and all the bank could do was make a claim. But because I scheduled the payment myself, the bank does not take responsibility for giving you that money back. They can try to work with Zelle to recover it, but in most cases the money is already gone, retrieved by the scammers or moved to another location. If you try and work with Zelle directly, they are not obligated to help you. Once I realized the severity of what had happened, I filed a police report with my local department. They were kind, but also told me the bank would probably not repay me the money I had lost. I won’t get into the exact dollar amount here, but it was no small amount. Of course I felt stupid and sick when I realized what had happened. But after doing some research, I found out this is one of the most common Zelle scams out there. In my case, it was a multi-layered scam because my debit and credit cards were also compromised. Someone treated themselves to a Spirit Airlines flight with my credit card, and we were able to get that refunded because Visa is insured. Zelle is not.

Not long after, I came across another scam online when a Facebook friend from high school posted that he had some puppies he needed to rehome. It so happened I was interested. But when I reached out to him via Facebook messenger, you could tell he had no idea who I was. I told him upfront I had been scammed online before, and did not want to send money online. The “friend” ignored that comment and said I needed to make a deposit to secure a puppy. I went back and forth for a few minutes, recognizing the sense of urgency I’d felt with the Zelle scam. The friend wouldn’t tell me where to pick up the puppy and even said once I sent the deposit, he would process the AKC paperwork, sending me a screenshot of a blank form. When he kept trying to show me how to send money through Facebook Pay, I told him to forget it. Then he turned mean, mentioning karma and how I was doing harm to his family. When I went back over to his Facebook post about the puppies, I noticed the comments had been locked. I knew then someone had taken over this person’s Facebook account and was attempting to swindle as many people as possible. I blocked the account, but if I hadn’t just been through the Zelle scam a few weeks earlier, I might have been susceptible.

That is just my personal experience. But I know I’m not alone. There are many other scams out there, and today we’re going to talk to a few cybersecurity experts for tips how to better protect ourselves. First, I want to talk about romance scams.

Romance Scams

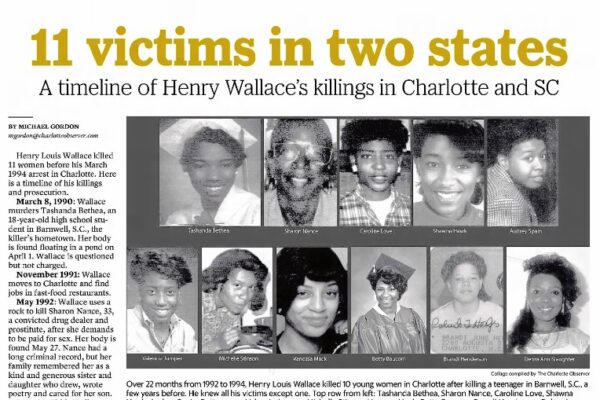

One emerging way that online scammers are finding victims is through dating apps. The anonymity of being behind a screen allows scammers to freely create fake profiles and pretend to be whoever they please. Using these profiles, they reach out to people feigning interest in a relationship, trying to earn their trust. The Federal Trade Commission (FTC) reported $1.3 billion in losses nationwide to these romance scams from 2017 to 2022.

The FBI reported that North Carolina citizens lost $18 million in 2022, ranking the state 9/50 for online romance scams. According to the online service Social Catfish, there were 422 victims in total, meaning that, on average, each North Carolina victim lost $42,752. In one case, a victim, Rebecca D’Antonio, lost over $100,000, causing her to go bankrupt. She told new channel CBS 17 “They know what to say to disarm you.” These scams don’t just cause financial strain but emotional damage as well. D’Antonio was suffering from depression, anxiety, and PTSD. She only cut ties with the scammer after he encouraged her to go through with her suicidal behavior. “He says to me, and I’ll never forget that cold indifference, well, you have to do what you have to do.” Suicide by the victim would lead to permanent silence for the scammer.

Thanks to the help of a reformed romance scammer, who goes by the name Chris, CBS 17 was able to get a more inside scoop on how scammers can coerce money this way. The trick is to play with the emotions of the victims and figure out what responses are most effective. They know exactly what to say, “It is like a formal step-by-step instruction. I have it on my phone,” said Chris. This instruction manual was 23 pages long. It details different scenarios people like Chris may come across, and how to become appealing using these scenarios. The emotional trauma was experienced not only by Chris’s victims but by himself as well. His breaking point came after he stole 20 grand from a woman in her late 50s, “I made her life so miserable that I just couldn’t… you know– I quit.”

How can people stay safe from this crime? The South Carolina Federal Credit Union has created a list of do’s and don’ts for those trying to find love online. It is easy to create fake profiles using pictures online of someone other than yourself. One of the most important steps when meeting somebody online is verifying their identity. This can mean meeting them in real life, or the use of video calls. It also is smart to run a background check, as fake profiles will have a lack of information. This should be done before giving out any sort of personal information. Even after you verify a person’s identity, the amount of personal information you share should be limited, and bank account information is never safe to share. In order to succeed with online dating, users must be vigilant and take extra precautions to ensure the identity of the person they are talking to.

Listen to the full episode, complete with two cybersecurity experts, here.